Credit Checker

Fast, Accurate Credit Insights Delivered Instantly in Salesforce

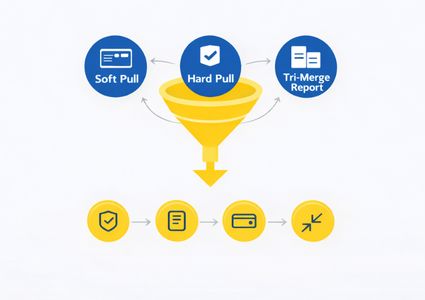

Run real-time credit checks and view credit scores directly inside Salesforce with native, secure integrations to the 3 major credit bureaus. Credit Checker delivers fast soft or hard pulls, tri-merge credit reports, and clear credit insights for confident decisions.

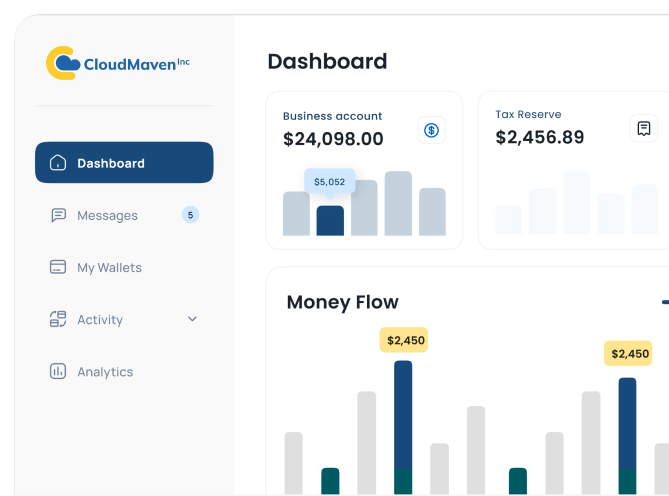

Make Better Decisions With Clear, Actionable Credit Insights

Instead of raw PDFs or messy files, you get structured, usable information that plugs right into your Salesforce workflows. It becomes simple to spot risk, compare applicants, or set automated rules based on credit score ranges or thresholds you define.

-p-1080%201.png)

Keep Sensitive Credit Data Truly Safe

Credit Checker stores everything the right way, encrypted, locked down, and logged, so your team can work confidently without worrying about compliance headaches. Every inquiry, whether a soft pull or hard pull, has a full record behind it.

-p-1080%201.png)

Let Salesforce Do the Work For You

The system can handle repetitive tasks, including scheduled pulls, stage-based checks, or automatic reviews, so nothing slips through the cracks. It’s credit checking that quietly happens in the background, not another chore for your team.

-p-1080%201.png)

Reduce Risk With Complete Credit Visibility

See the full story behind every applicant. Instead of relying on scattered reports, everything lands in one clean place: scores, tradelines, delinquencies, and the details you actually need. With complete credit visibility, your team isn’t guessing or digging for missing info.

-p-1080%201.png)

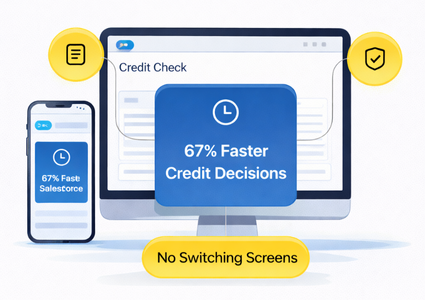

Get Credit Answers the Moment You Need Them

No more jumping between portals or waiting on manual reviews. Credit Checker pulls real-time data, whether it is a soft credit check, a hard inquiry, or a full tri-merge credit report, right inside Salesforce. You get answers fast, so decisions never stall.

-p-1080%201.png)

Results Our Customers See Every Day

Teams see decisions move noticeably quicker once credit checks happen right inside Salesforce. No switching screens, no waiting on manual pulls; just fast, clean results.

With credit scores and reports pulled automatically from the 3 bureaus, customers report far fewer copy-paste mistakes and missing data in their workflows.

By automating soft pulls, hard pulls, and tri-merge credit reports, bottlenecks in underwriting or application reviews shrink dramatically, freeing teams to focus on real decisions.

Because everything stays in your own org, customers gain confidence knowing almost all credit report data remains protected, logged, and audit-ready at all times.

The Advantages You’ll Notice Right Away

Run credit checks and pull credit scores right inside Salesforce, without slowing down your workflow or bouncing between different systems.

Keep every credit report and score in your own org, not an outside portal, so you stay in control of security, access, and visibility.

Whether you need a quick soft credit check or a full tri-merge credit report, Credit Checker delivers reliable results without delays.

Connect your bureau, map fields, and go. Salesforce takes over the routine credit score checks, saving your team time instantly.

No surprise bureau add-ons or extra charges. Just clear, predictable access whenever you need to run a credit check or pull a score.

Lenders, brokers, tenant screeners - any team using credit score checks can tailor the app to fit their process without extra tools.

Keep every credit report and score in your own org, not an outside portal, so you stay in control of security, access, and visibility.

Run credit checks and pull credit scores right inside Salesforce, without slowing down your workflow or bouncing between different systems.

Whether you need a quick soft credit check or a full tri merge credit report, Credit Checker delivers reliable results without delays.

Connect your bureau, map fields, and go. Salesforce takes over the routine credit score checks, saving your team time instantly.

No surprise bureau add-ons or extra charges. Just clear, predictable access whenever you need to run a credit check or pull a score.

Lenders, brokers, tenant screeners - any team using credit score checks can tailor the app to fit their process without extra tools.

Frequently Asked Questions

Which credit bureaus and data providers are supported?

Credit Checker integrates directly with the three major credit bureaus: Experian™, Equifax®, and TransUnion® to deliver real-time credit reports and credit score checks inside Salesforce. With seamless Salesforce Experian integration, Salesforce Equifax integration, and Salesforce TransUnion integration, you can access single-bureau or tri-merge credit reports for complete borrower insights and faster underwriting decisions.

Can I perform both soft and hard credit checks?

Yes. You can run soft credit checks (for prequalification) or hard credit pulls (for official lending). Soft pulls do not affect credit scores, while hard inquiries require the pulling of full bureau data for underwriting and risk assessment purposes, all configurable directly within Salesforce.

How secure is Credit Checker?

Every credit check and credit score pull happens securely within Salesforce, eliminating the potential for data exposure. Every transmission is encrypted, and the system complies with FCRA, GLBA, PCI-DSS, and Salesforce Shield standards, along with complete audit trails for compliance and traceability.

How quickly are credit scores and reports generated?

Credit Checker provides real-time credit score checks and credit reports within seconds of request. Whether it is a soft inquiry or a tri-merge credit report, Credit Checker delivers results instantly, helping lenders make faster, data-backed decisions without leaving Salesforce.

Does Credit Checker integrate with Salesforce workflows?

Yes. It works natively with Salesforce Flows, Apex, and Process Builder, enabling fully automated credit score checks from any object. You can even trigger reports automatically as part of your loan origination or tenant screening workflow.

Which countries are supported?

Credit Checker currently supports the United States, Canada, the United Kingdom, and Australia. Each region connects to localized bureau data and credit score ranges for more accurate risk assessment and regional compliance.

What type of analytics or dashboards are available?

Credit Checker offers real-time dashboards to track credit scores, tri-merge results, and bureau performance. You can visualize applicant score ranges, compare reports, and run bulk credit checks for portfolio-level insights without leaving Salesforce.

Learn. Build. Grow.

.png)

December 13, 2023

.png)

.png)